India boasts of big numbers. As of March 2013, India has 160 million internet users, and 86 million active users of mobile internet. The potential however is much bigger, with 430 million internet enabled mobile devices. Facebook, the poster child for India mobile usage, gets 30% of its new users via mobile registration, and 30% of its users are mobile only internet users.

Multiple businesses are actively pursuing this opportunity in 2014. In the first 5 months, we have seen campaigns from 6 separate websites - a significant portion of the campaigns are focused solely on mobile usage. Let's try and understand the intent behind each campaign and assess their effectiveness.

Note: The business objectives and campaign effectiveness mentioned below are based on own opinion and do not include any official inputs.

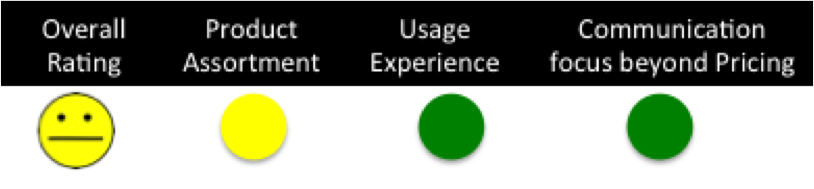

Key drivers of ecommerce business are broadly the factors below.

1. Product assortment - what the business offers within its declared universe

2. Experience - the usage journey from search, purchase to delivery

3. Pricing - offering a competitive price vs. offline or competing online channels

A combination of these help in driving consumer switching from traditional channels. However for brand positioning it is risky to solely depend on pricing. Over a longer period this is unlikely to deliver a winning model. This holds true for traditional channels too!

Part 1 - Acquiring Consumer Base

These campaigns have a clear objective of driving website awareness and new traffic.

Amazon India

The Amazon India campaign is spot on. They have picked 2 core drivers - assortment ("Over 1.5 Crore Products") and usage experience ("Guaranteed 1 Day Delivery"). The competitive couple context is also distinctive and breaks through clutter. The website is investing in deep discounting to close the sale once users seek desired products on Amazon. Hence while they offer cheaper products their positioning isn't based on pricing.

Magicbricks.com

Magicbricks promises to clear all confusion and mystery in property searches with an easy interface and thorough information. This is nicely contrasted with a caricatured property agent. Multiple creatives drive a consistent message. Since the competitors are not investing in awareness campaigns (like 99acres), magicbricks is likely to get good growth from the campaign.

Lenskart.com

Key question Lenskart needs to answer is why should consumers choose lenskart over the other giants like Flipkart and Amazon. The current launch campaign and the website experience doesn't do that. The storytelling with Purab is a bit laborious compared to other campaigns. The variety of products within eyecare is well established. Pricing incentives are kicked in when users land on the website - from offering first-frame free to 25% above purchase thresholds.

Snapdeal.com

Snapdeal covers a whole spectrum of products - from clothing to electronics to home accessories. This is communicated well via separate creatives. The snoopy maid character is distinctive and they should ideally hold on to the theme for a while. The key watchout is positioning of "Bachate Raho" which is hard to sustain long term.

Note: I still don't get the punchline "Madam asking to no, mein askoongina to click click"...

Quikr.com

Quikr's idea is based on delivering MSP (Maximum Selling Price) to the consumer. Multiple commercials are focused on the idea of a better price deal. This seems like a very limiting proposition for a peer-to-peer exchange website. Quikr will need to drive strengths on either usage experience or assortment (which is harder given that's dependent on user additions).

Do add your comments. In Part 2 we will look at campaigns driving mobile as a preferred device.

Source:

Mobile Playbook: http://www.themobileplaybook.com/en-us/

Analysis is on clinical on stated parameters. What I as a viewer sense is that the sticky factor of an ad dulls as the same ad is repeated. Multiple ads reinforcing the same theme is better. I will give examples after Part II.

ReplyDelete